Page 145 - Urban Renewal Authority 2023-24 Annual Report

P. 145

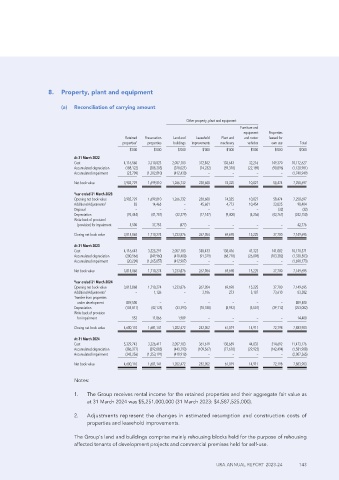

8. Property, plant and equipment

(a) Reconciliation of carrying amount

Other property, plant and equipment

Furniture and

equipment Properties

Retained Preservation Land and Leasehold Plant and and motor leased for

properties 1 properties buildings improvements machinery vehicles own use Total

$’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000

At 31 March 2022

Cost 4,116,560 3,310,823 2,057,183 312,832 133,643 32,216 149,370 10,112,627

Accumulated depreciation (188,122) (308,203) (378,021) (74,232) (59,318) (22,189) (90,896) (1,120,981)

Accumulated impairment (25,709) (1,302,810) (412,430) – – – – (1,740,949)

Net book value 3,902,729 1,699,810 1,266,732 238,600 74,325 10,027 58,474 7,250,697

Year ended 31 March 2023

Opening net book value 3,902,729 1,699,810 1,266,732 238,600 74,325 10,027 58,474 7,250,697

Additions/Adjustments 2 83 14,468 – 45,601 4,773 10,454 23,025 98,404

Disposal – – – – – – (32) (32)

Depreciation (92,444) (41,757) (32,379) (17,147) (9,400) (5,256) (43,767) (242,150)

Write back of provision/

(provision) for impairment 5,500 37,753 (477) – – – – 42,776

Closing net book value 3,815,868 1,710,274 1,233,876 267,054 69,698 15,225 37,700 7,149,695

At 31 March 2023

Cost 4,116,643 3,325,291 2,057,183 358,433 138,416 41,323 141,082 10,178,371

Accumulated depreciation (280,566) (349,960) (410,400) (91,379) (68,718) (26,098) (103,382) (1,330,503)

Accumulated impairment (20,209) (1,265,057) (412,907) – – – – (1,698,173)

Net book value 3,815,868 1,710,274 1,233,876 267,054 69,698 15,225 37,700 7,149,695

Year ended 31 March 2024

Opening net book value 3,815,868 1,710,274 1,233,876 267,054 69,698 15,225 37,700 7,149,695

Additions/Adjustments 2 – 1,126 – 3,186 273 5,187 73,610 83,382

Transfer from properties

under development 889,500 – – – – – – 889,500

Depreciation (105,811) (42,125) (33,393) (18,188) (8,952) (5,501) (39,112) (253,082)

Write back of provision

for impairment 553 11,866 1,989 – – – – 14,408

Closing net book value 4,600,110 1,681,141 1,202,472 252,052 61,019 14,911 72,198 7,883,903

At 31 March 2024

Cost 5,329,743 3,326,417 2,057,183 361,619 138,689 44,833 214,692 11,473,176

Accumulated depreciation (386,377) (392,085) (443,793) (109,567) (77,670) (29,922) (142,494) (1,581,908)

Accumulated impairment (343,256) (1,253,191) (410,918) – – – – (2,007,365)

Net book value 4,600,110 1,681,141 1,202,472 252,052 61,019 14,911 72,198 7,883,903

Notes:

1. The Group receives rental income for the retained properties and their aggregate fair value as

at 31 March 2024 was $5,251,000,000 (31 March 2023: $4,587,525,000).

2. Adjustments represent the changes in estimated resumption and construction costs of

properties and leasehold improvements.

The Group’s land and buildings comprise mainly rehousing blocks held for the purpose of rehousing

affected tenants of development projects and commercial premises held for self-use.

URA ANNUAL REPORT 2023-24 143