Page 148 - Urban Renewal Authority 2023-24 Annual Report

P. 148

NOTES TO THE FINANCIAL STATEMENTS

(expressed in Hong Kong Dollars)

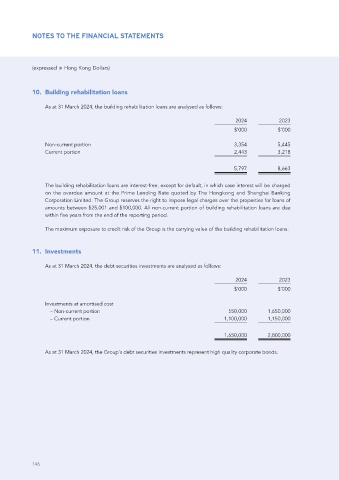

10. Building rehabilitation loans

As at 31 March 2024, the building rehabilitation loans are analysed as follows:

2024 2023

$’000 $’000

Non-current portion 3,354 5,445

Current portion 2,443 3,218

5,797 8,663

The building rehabilitation loans are interest-free, except for default, in which case interest will be charged

on the overdue amount at the Prime Lending Rate quoted by The Hongkong and Shanghai Banking

Corporation Limited. The Group reserves the right to impose legal charges over the properties for loans of

amounts between $25,001 and $100,000. All non-current portion of building rehabilitation loans are due

within five years from the end of the reporting period.

The maximum exposure to credit risk of the Group is the carrying value of the building rehabilitation loans.

11. Investments

As at 31 March 2024, the debt securities investments are analysed as follows:

2024 2023

$’000 $’000

Investments at amortised cost

– Non-current portion 550,000 1,650,000

– Current portion 1,100,000 1,150,000

1,650,000 2,800,000

As at 31 March 2024, the Group’s debt securities investments represent high quality corporate bonds.

146