Page 146 - Urban Renewal Authority 2023-24 Annual Report

P. 146

NOTES TO THE FINANCIAL STATEMENTS

(expressed in Hong Kong Dollars)

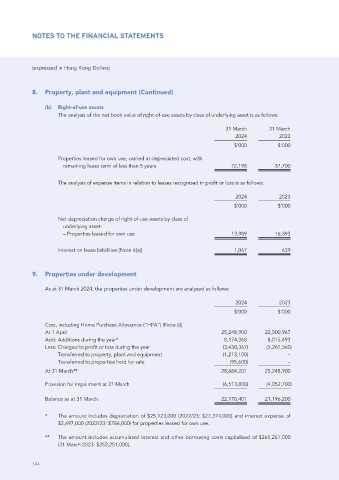

8. Property, plant and equipment (Continued)

(b) Right-of-use assets

The analysis of the net book value of right-of-use assets by class of underlying asset is as follows:

31 March 31 March

2024 2023

$’000 $’000

Properties leased for own use, carried at depreciated cost, with

remaining lease term of less than 5 years 72,198 37,700

The analysis of expense items in relation to leases recognised in profit or loss is as follows:

2024 2023

$’000 $’000

Net depreciation charge of right-of-use assets by class of

underlying asset:

– Properties leased for own use 13,989 16,393

Interest on lease liabilities (Note 6(a)) 1,067 639

9. Properties under development

As at 31 March 2024, the properties under development are analysed as follows:

2024 2023

$’000 $’000

Cost, including Home Purchase Allowance (“HPA”) (Note (i))

At 1 April 25,248,900 22,500,967

Add: Additions during the year* 8,174,368 8,015,493

Less: Charged to profit or loss during the year (3,430,367) (5,267,560)

Transferred to property, plant and equipment (1,213,100) –

Transferred to properties held for sale (95,600) –

At 31 March** 28,684,201 25,248,900

Provision for impairment at 31 March (6,513,800) (4,052,700)

Balance as at 31 March 22,170,401 21,196,200

* The amount includes depreciation of $25,123,000 (2022/23: $27,374,000) and interest expense of

$2,497,000 (2022/23: $786,000) for properties leased for own use.

** The amount includes accumulated interest and other borrowing costs capitalised of $265,261,000

(31 March 2023: $252,251,000).

144