Page 140 - Urban Renewal Authority 2023-24 Annual Report

P. 140

NOTES TO THE FINANCIAL STATEMENTS

(expressed in Hong Kong Dollars)

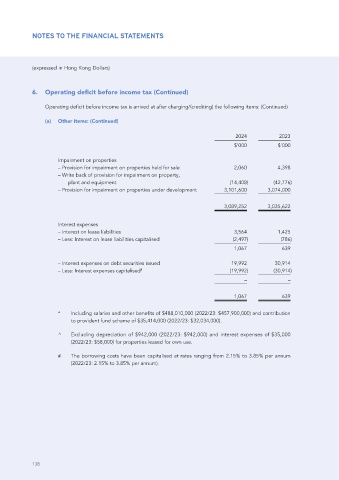

6. Operating deficit before income tax (Continued)

Operating deficit before income tax is arrived at after charging/(crediting) the following items: (Continued)

(a) Other items: (Continued)

2024 2023

$’000 $’000

Impairment on properties

– Provision for impairment on properties held for sale 2,060 4,398

– Write back of provision for impairment on property,

plant and equipment (14,408) (42,776)

– Provision for impairment on properties under development 3,101,600 3,074,000

3,089,252 3,035,622

Interest expenses

– Interest on lease liabilities 3,564 1,425

– Less: Interest on lease liabilities capitalised (2,497) (786)

1,067 639

– Interest expenses on debt securities issued 19,992 30,914

– Less: Interest expenses capitalised # (19,992) (30,914)

– –

1,067 639

* Including salaries and other benefits of $488,010,000 (2022/23: $457,900,000) and contribution

to provident fund scheme of $35,414,000 (2022/23: $32,034,000).

^ Excluding depreciation of $942,000 (2022/23: $942,000) and interest expenses of $35,000

(2022/23: $58,000) for properties leased for own use.

# The borrowing costs have been capitalised at rates ranging from 2.15% to 3.85% per annum

(2022/23: 2.15% to 3.85% per annum).

138