Page 147 - Urban Renewal Authority 2023-24 Annual Report

P. 147

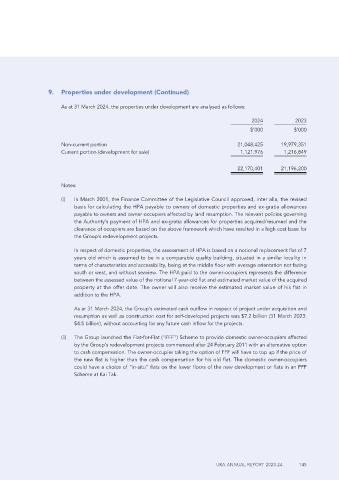

9. Properties under development (Continued)

As at 31 March 2024, the properties under development are analysed as follows:

2024 2023

$’000 $’000

Non-current portion 21,048,425 19,979,351

Current portion (development for sale) 1,121,976 1,216,849

22,170,401 21,196,200

Notes:

(i) In March 2001, the Finance Committee of the Legislative Council approved, inter alia, the revised

basis for calculating the HPA payable to owners of domestic properties and ex-gratia allowances

payable to owners and owner-occupiers affected by land resumption. The relevant policies governing

the Authority’s payment of HPA and ex-gratia allowances for properties acquired/resumed and the

clearance of occupiers are based on the above framework which have resulted in a high cost base for

the Group’s redevelopment projects.

In respect of domestic properties, the assessment of HPA is based on a notional replacement flat of 7

years old which is assumed to be in a comparable quality building, situated in a similar locality in

terms of characteristics and accessibility, being at the middle floor with average orientation not facing

south or west, and without seaview. The HPA paid to the owner-occupiers represents the difference

between the assessed value of the notional 7-year-old flat and estimated market value of the acquired

property at the offer date. The owner will also receive the estimated market value of his flat in

addition to the HPA.

As at 31 March 2024, the Group’s estimated cash outflow in respect of project under acquisition and

resumption as well as construction cost for self-developed projects was $7.2 billion (31 March 2023:

$4.5 billion), without accounting for any future cash inflow for the projects.

(ii) The Group launched the Flat-for-Flat (“FFF”) Scheme to provide domestic owner-occupiers affected

by the Group’s redevelopment projects commenced after 24 February 2011 with an alternative option

to cash compensation. The owner-occupier taking the option of FFF will have to top up if the price of

the new flat is higher than the cash compensation for his old flat. The domestic owner-occupiers

could have a choice of “in-situ” flats on the lower floors of the new development or flats in an FFF

Scheme at Kai Tak.

URA ANNUAL REPORT 2023-24 145