Page 136 - Urban Renewal Authority 2023-24 Annual Report

P. 136

NOTES TO THE FINANCIAL STATEMENTS

(expressed in Hong Kong Dollars)

3. Financial risk management and fair value of financial instruments (Continued)

(a) Financial risk factors (Continued)

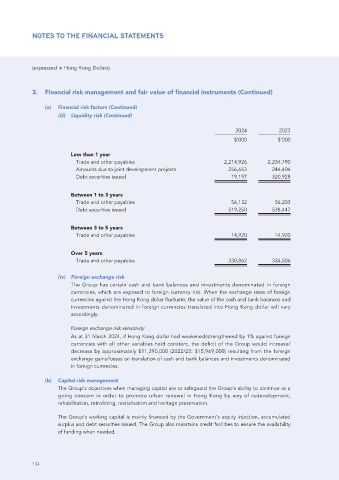

(iii) Liquidity risk (Continued)

2024 2023

$’000 $’000

Less than 1 year

Trade and other payables 2,214,926 2,234,790

Amounts due to joint development projects 256,653 244,404

Debt securities issued 19,197 320,928

Between 1 to 3 years

Trade and other payables 56,132 36,203

Debt securities issued 519,250 538,447

Between 3 to 5 years

Trade and other payables 14,920 14,920

Over 5 years

Trade and other payables 330,862 334,506

(iv) Foreign exchange risk

The Group has certain cash and bank balances and investments denominated in foreign

currencies, which are exposed to foreign currency risk. When the exchange rates of foreign

currencies against the Hong Kong dollar fluctuate, the value of the cash and bank balances and

investments denominated in foreign currencies translated into Hong Kong dollar will vary

accordingly.

Foreign exchange risk sensitivity

As at 31 March 2024, if Hong Kong dollar had weakened/strengthened by 1% against foreign

currencies with all other variables held constant, the deficit of the Group would increase/

decrease by approximately $11,390,000 (2022/23: $15,969,000) resulting from the foreign

exchange gains/losses on translation of cash and bank balances and investments denominated

in foreign currencies.

(b) Capital risk management

The Group’s objectives when managing capital are to safeguard the Group’s ability to continue as a

going concern in order to promote urban renewal in Hong Kong by way of redevelopment,

rehabilitation, retrofitting, revitalisation and heritage preservation.

The Group’s working capital is mainly financed by the Government’s equity injection, accumulated

surplus and debt securities issued. The Group also maintains credit facilities to ensure the availability

of funding when needed.

134