Page 159 - Urban Renewal Authority 2023-24 Annual Report

P. 159

19. Provident fund scheme

The Group provides retirement benefits to its eligible employees under defined contribution schemes. In

accordance with the Mandatory Provident Fund Schemes Ordinance, the eligible employees enjoy

retirement benefits under the Mandatory Provident Fund Exempted ORSO Scheme or the Mandatory

Provident Fund Scheme (the “Schemes”) under which employer’s voluntary contributions have been made.

The assets of the Schemes are held separately from those of the Group and managed by independent

administrators. The Group normally makes voluntary contributions ranging from 5% to 10% of the

employees’ monthly salaries depending on the years of service of the employees.

The total amount contributed by the Group into the Schemes for the year ended 31 March 2024 was

$38,541,000 (2022/23: $34,821,000), net of forfeitures of $2,917,000 (2022/23: $3,434,000), which has

been charged to the Group’s profit or loss for the year.

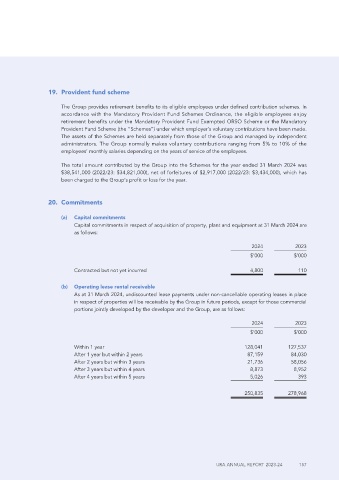

20. Commitments

(a) Capital commitments

Capital commitments in respect of acquisition of property, plant and equipment at 31 March 2024 are

as follows:

2024 2023

$’000 $’000

Contracted but not yet incurred 4,800 110

(b) Operating lease rental receivable

As at 31 March 2024, undiscounted lease payments under non-cancellable operating leases in place

in respect of properties will be receivable by the Group in future periods, except for those commercial

portions jointly developed by the developer and the Group, are as follows:

2024 2023

$’000 $’000

Within 1 year 128,041 127,537

After 1 year but within 2 years 87,159 84,030

After 2 years but within 3 years 21,736 58,056

After 3 years but within 4 years 8,873 8,952

After 4 years but within 5 years 5,026 393

250,835 278,968

URA ANNUAL REPORT 2023-24 157