Page 125 - Urban Renewal Authority 2023-24 Annual Report

P. 125

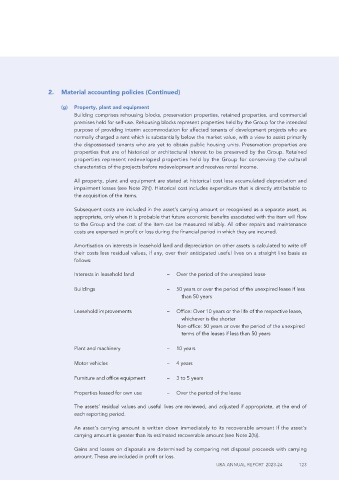

2. Material accounting policies (Continued)

(g) Property, plant and equipment

Building comprises rehousing blocks, preservation properties, retained properties, and commercial

premises held for self-use. Rehousing blocks represent properties held by the Group for the intended

purpose of providing interim accommodation for affected tenants of development projects who are

normally charged a rent which is substantially below the market value, with a view to assist primarily

the dispossessed tenants who are yet to obtain public housing units. Preservation properties are

properties that are of historical or architectural interest to be preserved by the Group. Retained

properties represent redeveloped properties held by the Group for conserving the cultural

characteristics of the projects before redevelopment and receives rental income.

All property, plant and equipment are stated at historical cost less accumulated depreciation and

impairment losses (see Note 2(h)). Historical cost includes expenditure that is directly attributable to

the acquisition of the items.

Subsequent costs are included in the asset’s carrying amount or recognised as a separate asset, as

appropriate, only when it is probable that future economic benefits associated with the item will flow

to the Group and the cost of the item can be measured reliably. All other repairs and maintenance

costs are expensed in profit or loss during the financial period in which they are incurred.

Amortisation on interests in leasehold land and depreciation on other assets is calculated to write off

their costs less residual values, if any, over their anticipated useful lives on a straight line basis as

follows:

Interests in leasehold land – Over the period of the unexpired lease

Buildings – 50 years or over the period of the unexpired lease if less

than 50 years

Leasehold improvements – Office: Over 10 years or the life of the respective lease,

whichever is the shorter

Non-office: 50 years or over the period of the unexpired

terms of the leases if less than 50 years

Plant and machinery – 10 years

Motor vehicles – 4 years

Furniture and office equipment – 3 to 5 years

Properties leased for own use – Over the period of the lease

The assets’ residual values and useful lives are reviewed, and adjusted if appropriate, at the end of

each reporting period.

An asset’s carrying amount is written down immediately to its recoverable amount if the asset’s

carrying amount is greater than its estimated recoverable amount (see Note 2(h)).

Gains and losses on disposals are determined by comparing net disposal proceeds with carrying

amount. These are included in profit or loss.

URA ANNUAL REPORT 2023-24 123