Page 155 - URA Annual Report 2021-22

P. 155

(expressed in Hong Kong Dollars)

6. Operating surplus before income tax (Continued)

Operating surplus before income tax is arrived at after charging/(crediting) the following items: (Continued)

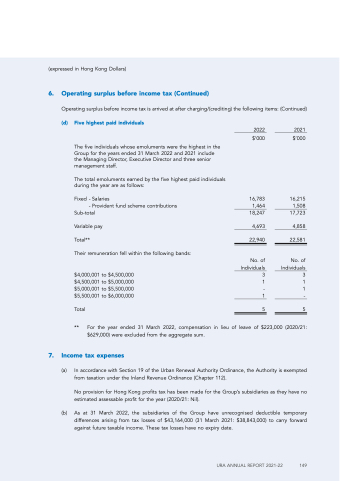

(d) Five highest paid individuals

The five individuals whose emoluments were the highest in the Group for the years ended 31 March 2022 and 2021 include the Managing Director, Executive Director and three senior management staff.

The total emoluments earned by the five highest paid individuals during the year are as follows:

Fixed - Salaries

- Provident fund scheme contributions

2022 $’000

2021 $’000

16,215 1,508 17,723

4,858

22,581

No. of Individuals 3 1 1 -

16,783 1,464 Sub-total 18,247

Variable pay 4,693 Total** 22,940 Their remuneration fell within the following bands:

$4,000,001 to $4,500,000 $4,500,001 to $5,000,000 $5,000,001 to $5,500,000 $5,500,001 to $6,000,000

No. of Individuals 3 1 - 1

Total 5

** For the year ended 31 March 2022, compensation in lieu of leave of $223,000 (2020/21:

$629,000) were excluded from the aggregate sum.

7. Income tax expenses

(a) In accordance with Section 19 of the Urban Renewal Authority Ordinance, the Authority is exempted from taxation under the Inland Revenue Ordinance (Chapter 112).

No provision for Hong Kong profits tax has been made for the Group’s subsidiaries as they have no estimated assessable profit for the year (2020/21: Nil).

(b) As at 31 March 2022, the subsidiaries of the Group have unrecognised deductible temporary differences arising from tax losses of $43,164,000 (31 March 2021: $38,843,000) to carry forward against future taxable income. These tax losses have no expiry date.

5

URA ANNUAL REPORT 2021-22 149