Page 161 - URA Annual Report 2021-22

P. 161

(expressed in Hong Kong Dollars)

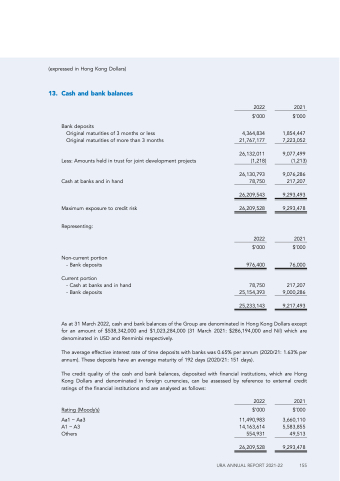

13. Cash and bank balances

Bank deposits

Original maturities of 3 months or less Original maturities of more than 3 months

Less: Amounts held in trust for joint development projects Cash at banks and in hand

Maximum exposure to credit risk Representing:

Non-current portion - Bank deposits

Current portion

- Cash at banks and in hand - Bank deposits

2022 $’000

4,364,834 21,767,177

26,132,011 (1,218)

26,130,793 78,750

26,209,543 26,209,528

2022 $’000

976,400 78,750

25,154,393

25,233,143

2021 $’000

1,854,447 7,223,052

9,077,499 (1,213)

9,076,286 217,207

9,293,493 9,293,478

2021 $’000

76,000 217,207

9,000,286

9,217,493

As at 31 March 2022, cash and bank balances of the Group are denominated in Hong Kong Dollars except for an amount of $538,342,000 and $1,023,284,000 (31 March 2021: $286,194,000 and Nil) which are denominated in USD and Renminbi respectively.

The average effective interest rate of time deposits with banks was 0.65% per annum (2020/21: 1.63% per annum). These deposits have an average maturity of 192 days (2020/21: 151 days).

The credit quality of the cash and bank balances, deposited with financial institutions, which are Hong Kong Dollars and denominated in foreign currencies, can be assessed by reference to external credit ratings of the financial institutions and are analysed as follows:

2022 $’000

Aa1 – Aa3

A1 – A3

Others 554,931

26,209,528

2021 $’000

3,660,110 5,583,855 49,513

9,293,478

Rating (Moody’s)

11,490,983 14,163,614

URA ANNUAL REPORT 2021-22 155